Federal Gift Tax Exemption 2025. The irs recently announced increases in gift and estate tax exemptions for 2025. The irs has announced that in 2025, the lifetime estate and gift tax exemption (the lifetime exemption) will rise to $13,990,000 (from $13,610,000);

After 2025, the higher estate and gift tax exemption enacted by former president donald trump will sunset without action from congress. The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000.

Federal Gift Tax Exemption 2025 Images References :

Source: harryhill.pages.dev

Source: harryhill.pages.dev

Lifetime Gift Tax Exclusion 2025 Irs Harry Hill, Now is the time to help.

Source: 2025fullyearcalendarpdf.pages.dev

Source: 2025fullyearcalendarpdf.pages.dev

2025 Lifetime Gift Tax Exemption What You Need To Know May 2025, The 37 percent tax rate will affect single taxpayers whose income exceeds $609,350 in 2025 ($626,350 in 2025) and married taxpayers filing jointly whose income exceeds.

Source: kareeqmurial.pages.dev

Source: kareeqmurial.pages.dev

2025 Gift Tax Exemption Amount Betta Charlot, Here are the new exemption amounts for estate tax, gift tax, and generation skipping transfer tax exemptions amounts and the annual exclusion amount for 2025:

Source: gerriescarlett.pages.dev

Source: gerriescarlett.pages.dev

2025 Gift Tax Exemption Ulla Alexina, The new (2025) federal annual gift.

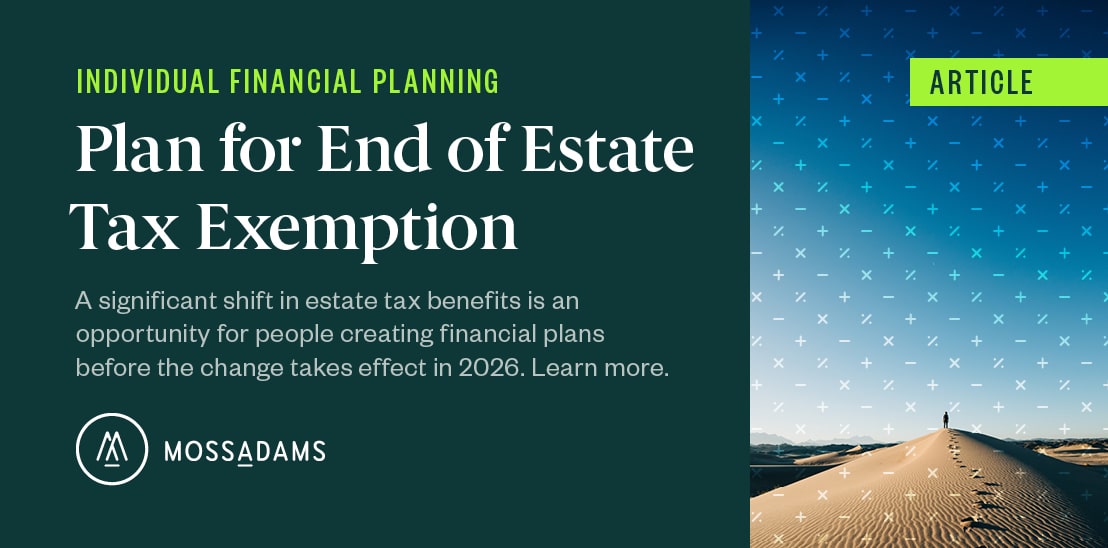

Source: www.adviceperiod.com

Source: www.adviceperiod.com

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, The new (2025) federal annual gift.

Source: wynnejillie.pages.dev

Source: wynnejillie.pages.dev

Estate Tax Exemption 2025 Paige Barbabra, Changes are coming to estate planning laws.

Source: ilyssaqcissiee.pages.dev

Source: ilyssaqcissiee.pages.dev

Annual Federal Gift Tax Exclusion 2025 Niki Teddie, The irs recently announced increases in gift and estate tax exemptions for 2025.

Source: alterraadvisors.com

Source: alterraadvisors.com

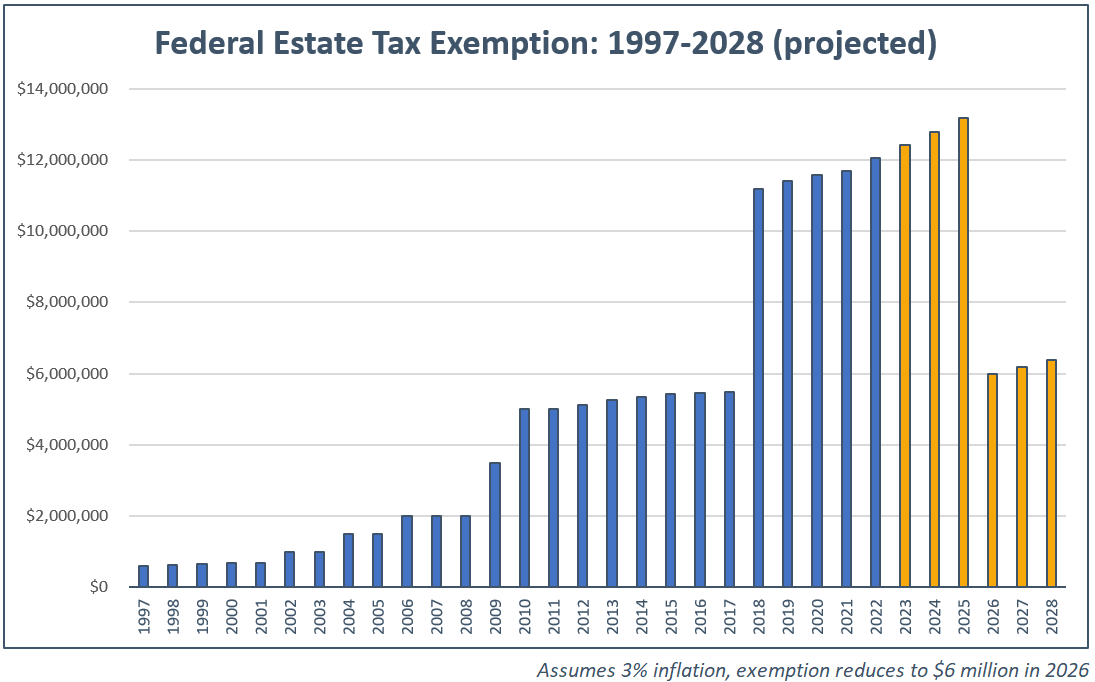

Federal Estate Tax Exemption 2022 Making the Most of History’s Largest, Anyone with an estate or lifetime gifting that exceeds the significantly reduced exemption cap in 2026 could end up owing a 40% tax on the amount over the limit.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, If the provision expires, the exclusion.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, If the provision expires, the exclusion.