Irs Form 1099-Nec 2025. By accurately completing and timely filing this form,. As soon as new 2025 relevant tax year data has been.

This is the governments way to ensure that if you are taking a business deduction,. As soon as new 2025 relevant tax year data has been.

If The Following Four Conditions Are Met, You Must.

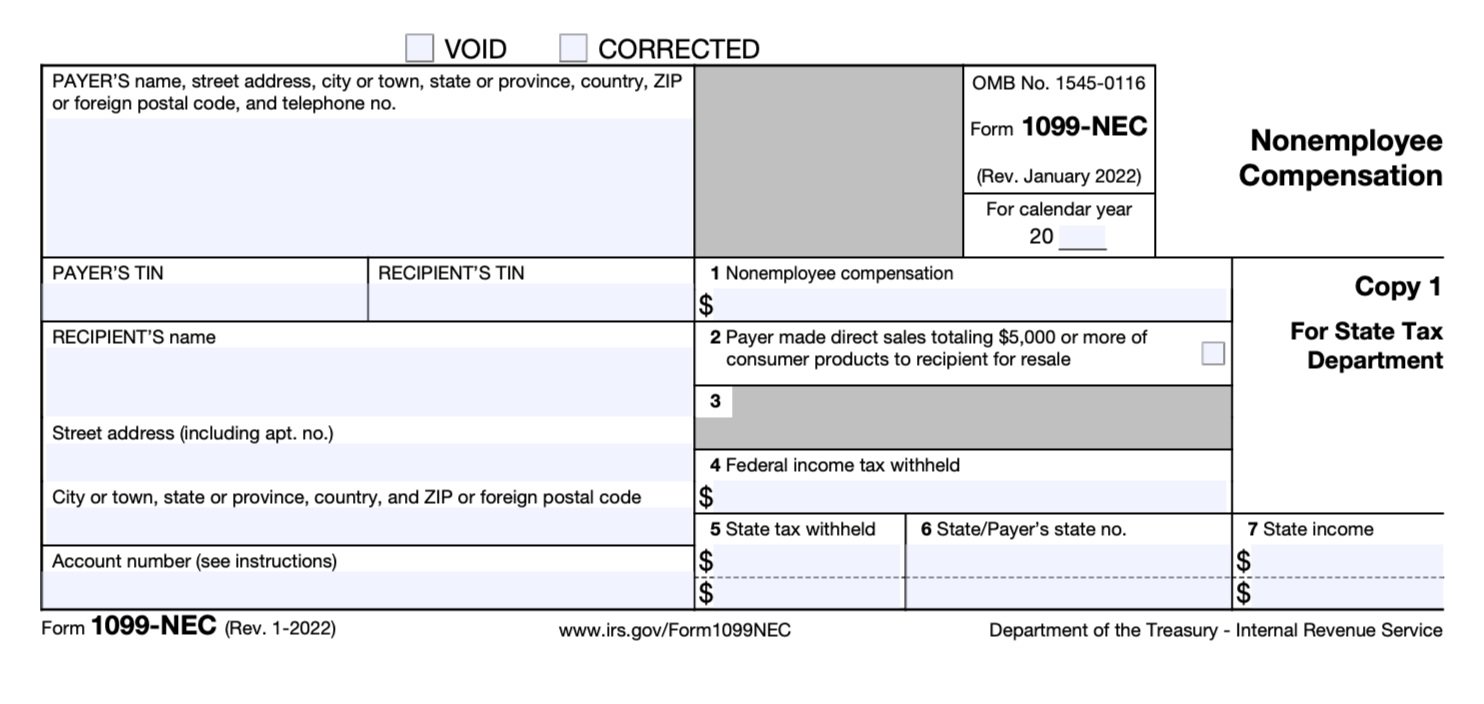

A 1099 form is a tax statement you may receive from a bank, a broker, a business or another entity paying you nonemployee compensation throughout the year.

Small Business Owners Have A Number Of Tasks To Complete During Tax Season, And One Important Step Is Providing 1099 Forms To Independent Contractors.

This is the governments way to ensure that if you are taking a business deduction,.

Irs Form 1099-Nec 2025 Images References :

Source: flyfin.tax

Source: flyfin.tax

How To Use the IRS 1099NEC Form FlyFin, By accurately completing and timely filing this form,. The ssa shares the information with the internal revenue service.

Source: forst.tax

Source: forst.tax

How to File Your Taxes if You Received a Form 1099NEC, This is the governments way to ensure that if you are taking a business deduction,. The ssa shares the information with the internal revenue service.

Source: www.youtube.com

Source: www.youtube.com

What is IRS Form 1099NEC? TaxBandits YouTube, If the following four conditions are met, you must. This is the governments way to ensure that if you are taking a business deduction,.

Source: falconexpenses.com

Source: falconexpenses.com

What is Form 1099NEC for Nonemployee Compensation, This form covers a variety of income sources, such as rent,. This form is used to report nonemployee compensation for independent contractors.

IRS Reintroduces Form 1099NEC for NonEmployees Wendroff, If the following four conditions are met, you must. This is the governments way to ensure that if you are taking a business deduction,.

Source: old.sermitsiaq.ag

Source: old.sermitsiaq.ag

Printable Irs Form 1099 Nec, If the following four conditions are met, you must. Small business owners have a number of tasks to complete during tax season, and one important step is providing 1099 forms to independent contractors.

Source: studycampushartmann.z21.web.core.windows.net

Source: studycampushartmann.z21.web.core.windows.net

Irs 1099 Nec Printable Form, This form is used to report nonemployee compensation for independent contractors. This is the governments way to ensure that if you are taking a business deduction,.

Source: blog.stridehealth.com

Source: blog.stridehealth.com

What Is a 1099NEC? — Stride Blog, As soon as new 2025 relevant tax year data has been. The ssa shares the information with the internal revenue service.

Source: www.youtube.com

Source: www.youtube.com

IRS Form 1099NEC walkthrough (Nonemployee Compensation) YouTube, This tax return and refund estimator is for tax year 2025 and currently based on 2024/2025 tax year tax tables. If the following four conditions are met, you must.

Source: www.youtube.com

Source: www.youtube.com

How to Complete IRS Form 1099 NEC YouTube, This form is used to report nonemployee compensation for independent contractors. A 1099 form is a tax statement you may receive from a bank, a broker, a business or another entity paying you nonemployee compensation throughout the year.

As Soon As New 2025 Relevant Tax Year Data Has Been.

A 1099 form is a tax statement you may receive from a bank, a broker, a business or another entity paying you nonemployee compensation throughout the year.

This Form Covers A Variety Of Income Sources, Such As Rent,.

If the following four conditions are met, you must.